Download the full report | Résumé analytique

Key Findings

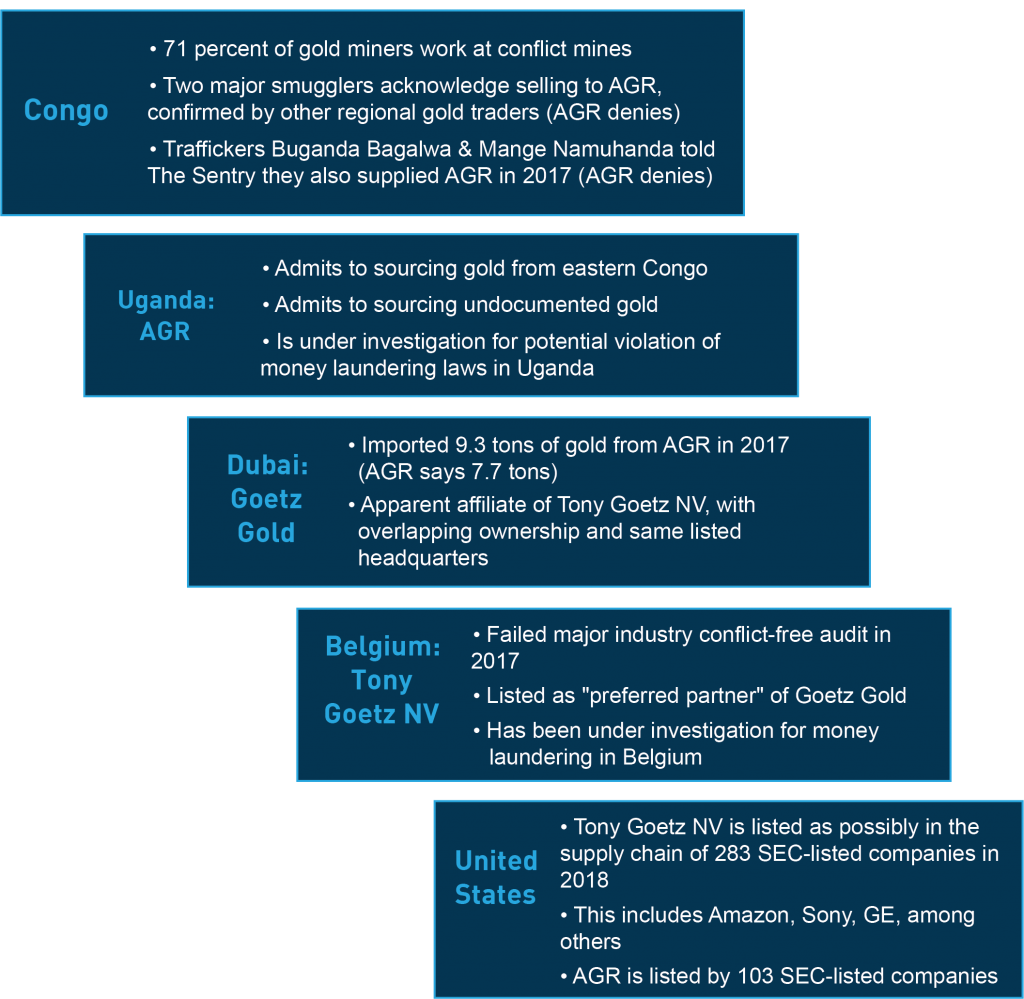

- An investigation by The Sentry raises significant concerns that gold mined from conflict areas in eastern Democratic Republic of Congo (“Congo”) is reaching international markets, including the supply chains of major U.S. companies and in products that consumers use every day.

- Documents reviewed and interviews conducted by The Sentry raise serious concern that the corporate network controlled by Belgian tycoon Alain Goetz has refined illegally-smuggled conflict gold from eastern Congo at the African Gold Refinery (AGR) in Uganda and then exported it through a series of companies to the United States and Europe, potentially including Amazon, General Electric (GE), and Sony.

- According to documents reviewed by The Sentry, AGR exported approximately $377 million in gold in 2017 to an apparent affiliate of the Belgian gold refinery Tony Goetz NV, based in Dubai. Numerous sources interviewed by The Sentry identified AGR as sourcing conflict gold from Congo. AGR denies this and maintains that it is committed to refraining from any action that contributes to the financing of conflict.

- According to the U.N., conflict gold provides the largest source of revenue to armed actors in the conflict in eastern Congo, and $300 to $600 million is smuggled out of Congo annually.

- This gold may wind up in the supply chains of major western corporations. Amazon, Sony, GE, and 280 other U.S. publicly traded companies listed the Belgian refinery as an entity that may be in their supply chains, according to 2018 SEC filings, despite the fact that it failed a major international conflict minerals audit in 2017.

- Numerous sources interviewed by The Sentry identified AGR as sourcing conflict gold from Congo. Two major gold smugglers in Congo acknowledged to The Sentry that they illegally trafficked gold from eastern Congo to AGR, and other regional gold traders corroborated these accounts. Furthermore, four regional traders told The Sentry that gold traffickers Buganda Bagalwa and Mange Namuhanda, who have been named in several U.N. Group of Experts reports on Congo as purchasers of conflict gold, supplied gold to AGR in 2017. AGR denies having received gold from these traders and denies that it has otherwise received significant amounts of undocumented gold from other sources.

- Several corporate practices of AGR appear to raise red flags as indicators of potential money laundering as established by the world’s leading intergovernmental body on anti-money laundering, the Financial Action Task Force (FATF), according to documents reviewed by The Sentry.

- The trail of conflict gold follows a roughly six-step supply chain from eastern Congo to its main end-products, jewelry, gold bars for investors and banks, and electronics.

From Congo to the United States? The Goetz network supply chain

Editor’s Note: Following the initial publication of this report, The Sentry has become aware of news reports indicating that, in addition to AGR, two additional companies may have recently received licenses to operate gold refineries in Uganda.

Executive Summary

An investigation by The Sentry raises significant concerns that gold mined from conflict areas in eastern Democratic Republic of Congo (“Congo”) is reaching international markets, including the supply chains of major U.S. companies and in products that consumers use every day. Documents reviewed and interviews conducted by The Sentry raise serious concern that the corporate network controlled by Belgian tycoon Alain Goetz has refined illegally-smuggled conflict gold from eastern Congo at the African Gold Refinery (AGR) in Uganda and then exported it through a series of companies to the United States and Europe, potentially including Amazon, General Electric (GE), and Sony. According to the United Nations (U.N.), conflict gold provides the largest source of revenue to armed actors in the conflict in eastern Congo,* where an estimated 3.3 to 7.6 million people have died.* An estimated $300 to $600 million worth of gold is smuggled out of Congo each year.*

According to documents reviewed by The Sentry, AGR exported approximately $377 million in gold in 2017 to an apparent affiliate of the Belgian gold refinery Tony Goetz NV, based in Dubai. * According to 2018 U.S. Securities and Exchange Commission filings, 283 publicly-traded companies in the U.S. listed the Belgian refinery as an entity that may be in their supply chains,* despite the fact that the refinery failed a major international conflict minerals audit in 2017. * Those same filings indicate that AGR itself, opened in Uganda in 2016 and owned by Goetz, * may also be in the supply chains of 103 publicly traded U.S. companies, including GE and Halliburton.*

Numerous sources interviewed by The Sentry identified AGR as sourcing conflict gold from Congo. Twelve different traders and government officials in the region told The Sentry that AGR has taken over a significant portion of the market for gold trafficked from Congo to Uganda and the region,* and Ugandan export records reviewed by The Sentry show that AGR accounted for over 99 percent of gold officially exported from Uganda in 2017.* Uganda is the main transit hub for gold smuggled out of Congo, according to the U.N. Group of Experts (with Rwanda growing as such). * Two major gold smugglers in Congo acknowledged to The Sentry that they illegally trafficked gold from eastern Congo to AGR,* and other regional gold traders corroborated these accounts.* Furthermore, four regional traders told The Sentry that gold traffickers Buganda Bagalwa and Mange Namuhanda, who have been named in several U.N. Group of Experts reports on Congo as purchasers of conflict gold,* supplied gold to AGR in 2017. * AGR specifically denies having received gold from Bagalwa or Namuhanda and denies generally that it has otherwise received significant amounts of undocumented gold from other sources.* Goetz has set up a major gold trading hub in Rwanda as well.*

The activities of the network appear to be noncompliant with both international supply chain due diligence guidance and international anti-money laundering safeguards as the network’s companies buy, refine, and then sell the gold. As a result, the hundreds of publicly listed U.S. companies that may source gold from the refineries in this network are at risk of purchasing conflict gold. Goetz is a director or owner of 15 different companies, from Uganda, Dubai, Belgium, and Luxembourg, and 8 of these companies have the same address in Belgium.*

For its part, AGR steadfastly maintains that it is committed to refraining from any action that contributes to the financing of conflict and that its due diligence systems are based on international guidance.* Further, Tony Goetz NV asserts that it follows strict procedures to avoid sourcing conflict minerals and that it follows all laws and international guidelines.*

Nevertheless, according to documents reviewed and sources interviewed by The Sentry, there is a significant risk that AGR has sourced large volumes of gold from eastern Congo with undocumented origins and lacking conflict-free certification. Although AGR has confirmed that it sources gold from Congo and that it sources some undocumented gold,* it insists that the latter comes from old jewelry and other scrap sources.* However, sourcing scrap from countries known to be transit points for conflict gold is a red flag in international due diligence guidance because it can be a loophole for mixing in gold from conflict sources.*

It is illegal, according to Congolese law, to export gold from artisanal mines that are not certified as conflict-free in Congo.* An estimated 96 percent of artisanal gold mines in Congo are not certified at present (60 out of approximately 1,499),* an estimated 71 percent of gold miners work at conflict mines according to the latest independent survey,* and in 2017 the U.N. Group of Experts said that it had confirmed that nearly all artisanally sourced gold in Congo was exported illegally.* In sum, nearly all of the gold mined in Congo flowing to Uganda is very likely not from certified mines.

According to Ugandan export records, AGR also exported gold in 2017 to a Dubai-based company that in 2012 had reportedly been one of the most important cash suppliers to Kaloti Precious Metals, the Dubai-based gold refining giant.* In 2015, a Kaloti refinery was de-listed from the Dubai “Good Delivery” list after failing to meet the criteria for Good Delivery certification and following a gold sourcing scandal.* AGR has denied exporting to this company or knowing of the links between the supplier and Kaloti.*

Goetz’s new gold trading operation in Rwanda is also significant, exporting approximately one ton of gold per month since November 2017 (the equivalent of $500 million per year),* according to the U.N. Group of Experts.* The U.N. Group of Experts concluded in 2018 that much of the gold traded in Rwanda and Uganda is smuggled from Congo and/or other neighboring countries.*

In 2016 and 2017, it appears that Goetz’s network effectively assumed much of the market share previously controlled by another Uganda-based gold trading network run by the directors of Uganda Commercial Impex, which has been extensively involved in sourcing uncertified gold from eastern Congo for more than a decade, according to the U.N. Group of Experts.* That network has greatly decreased its trade but remains somewhat active and in competition with Goetz, according to regional experts and the U.N. Group of Experts.* The smuggling of gold from eastern Congo and the region by hand using commercial airlines also remains a key area of concern.*

The Sentry conducted over 100 interviews with gold miners, traders, and civil society organizations in Congo for this report. The investigation found evidence of armed groups and army commanders collecting illegal taxes on miners, government agents, and businessmen, and of clashes between armed groups and the Congolese army at gold mines. The trail of conflict gold follows a roughly six-step supply chain from eastern Congo to its primary end-products – jewelry, gold bars for investors and banks, and electronics.*

Uganda, where AGR is the only gold refinery, is the main transit hub for smuggled gold from eastern Congo, according to U.N. Group of Experts reports.* Following AGR’s opening, Uganda increased its gold exports by a staggering 85,000 percent, going from exporting approximately $443,000 worth of gold in 2014 to an estimated $377 million in 2017.* AGR signed agreements with a relative of Ugandan President Yoweri Museveni named Barnabas Taremwa, who the U.N. Group of Experts says traded in illegally trafficked gold from Congo,* as well as a former high-level Ugandan official and childhood friend of President Museveni, who resigned from the World Bank following reports of alleged bribery.* AGR has halted relationships with both men, but Taremwa has sued.*

Anti-money laundering (AML) practices are another key area of concern for certain companies in the Goetz network. Uganda’s Financial Intelligence Authority referred AGR to the Director of Public Prosecutions for prosecution for violation of AML laws.* However, the case has not gone forward. Some Ugandan officials say this lack of action is a result of Goetz’s relationship with President Museveni, who recommended that Uganda give AGR incentives to do business in the country.* AGR denies having any commercial relationship with Museveni or any other senior Ugandan government officials.*

Several corporate practices of AGR and the Goetz network of companies appear to raise AML red flags set forth by the Financial Action Task Force (FATF)* and to be inconsistent with U.N. Security Council and Organization for Economic Cooperation and Development (OECD) due diligence guidance on conflict minerals.* The FATF red flags are indicators of potential money laundering that should trigger enhanced scrutiny by banks and other companies. Potentially noncompliant practices of AGR and/or the Goetz network include failure to report to the national financial intelligence unit (FIU), the risk—described in this report—that it is trading in gold that is mined and traded illegally (which AGR denies),* setting up a complex web of companies with overlapping ownership structures and activities linked to the trade in Congo’s gold, and conducting inadequate due diligence given the high risk of sourcing conflict gold. Collectively, such practices raise the risk that AGR may be attempting to hide the origins of high-risk gold from Congo. Indeed, AGR continues to export gold in large volumes despite having received noncompliance notices from Uganda on licensing, disclosure, and registration.* The company maintains that, although it is not licensed by the mining ministry, all of its data is publicly available,* and it has expressed a desire to assist with mapping and traceability.* Goetz has insisted his business record is clean. “Conflict minerals don’t exist,” he stated in 2017. “All minerals are created by God.”*

Goetz co-owns Tony Goetz NV, the Belgian refinery whose apparent affiliate directly imports gold from AGR.* Although the company maintains that it has internal procedures to identify its clients and the origin of its gold, and avoid sourcing conflict minerals,* it failed a third-party audit of the Responsible Minerals Initiative (RMI) in 2017, which includes strict due diligence requirements on conflict minerals. Apple, Intel, and 345 multinational companies use RMI audits as a primary source for determining whether smelters meet responsible sourcing standards.* The RMI audit failure raises the question as to why the refinery remains certified by the main commodities trading association in Dubai, a global gold trading hub, as “Good Delivery,” a status that includes conflict-free requirements.* It was due to be re-audited in 2017 under the Dubai program, but no new audit report has been published.* In addition, European press has reported that Belgian authorities were also investigating Tony Goetz NV for possible money laundering.* The company asserts that its activities are in accordance with the law and that it follows strict AML procedures.*

AGR marks a return to the region for Goetz. He reportedly made deals with a major rebel group in Congo in 1997,* and the corporate network operated by Goetz and his father is estimated to have purchased over 100 tons of gold worth approximately $1.1 billion in the 1990s.*

International due diligence, responsible minerals audits, and AML frameworks were established in order to combat corruption and the deadly conflict minerals trade. Companies that fail such audits, and that do not adhere to such guidance yet continue to sell their minerals internationally must face steep consequences, or else there will be no change in the conflict gold trade that fuels armed conflict. The activities of such companies are a primary obstacle to increasing the conflict-free, responsible gold trade from Congo, which can help de-link the gold trade from conflict and help the Congolese people benefit from their natural resources. The Sentry makes the following recommendations:

Recommendations

- Targeted network sanctions. The United States, U.N. Security Council, and European Union should investigate and, if appropriate, sanction gold refining and trading companies and their beneficial owners discussed in this report. This should be done based on findings of support to persons, including armed groups, involved in activities that threaten the peace, security, or stability of the Congo through the illicit trade in natural resources, for example purchasing gold sourced from areas controlled by armed groups. A conclusion that any of the companies have failed to implement U.N. Security Council and OECD due diligence guidance for conflict and high-risk gold should factor into the analysis of how sanctions are applied. *

- Anti-money laundering measures (AML). The U.S. Department of the Treasury and financial intelligence units (FIUs) in Europe and East Africa should issue advisories to alert financial institutions on conflict and high-risk gold from East and Central Africa, highlighting in particular the significant risks presented by the trade in illicit gold from Congo, Uganda, and Rwanda, as described in this report. The advisories should build on the 2015 Financial Action Task Force (FATF) typology report on gold and money laundering by identifying ways in which gold is used to finance conflict and requesting increased reporting of suspicious activity. The U.S. Department of the Treasury should also investigate and, if appropriate, issue a finding, pursuant to Section 311 of the Patriot Act, that the trade in conflict and high-risk gold with certain traders is a “class of transactions” that constitutes a primary money laundering concern. These actions should be specifically worded to target launderers, but not discourage the legitimate, conflict-free trade.

- Prosecutions. The United States and European Union should urge the Ugandan government to vigorously pursue an investigation of AGR for potential money laundering and, if the investigation concludes that an indictment is warranted, prosecute those responsible for violating the law. Belgium, the United States, and the United Arab Emirates should investigate potential breaches of relevant mining, customs, anti-money laundering, and anti-corruption regulations in relation to AGR, Goetz Gold, Tony Goetz NV, and Uganda Commercial Impex.

- Use of AML red flags by banks. Banks and other gold purchasing companies should conduct enhanced scrutiny and refer to the red flags in the 2015 FATF typology report to assess risks when dealing with the gold refining and trading companies and their beneficial owners identified in this report to ensure that they are not inadvertently aiding in laundering the proceeds of conflict gold.* They should also ensure to take measures to support the responsible, conflict-free gold trade from Congo.

- Due diligence review and delisting/withdrawal of membership. The Dubai Multi Commodities Centre (DMCC) should immediately review whether to de-list Tony Goetz NV from its “Good Delivery” list.

- Improved AML implementation. The U.S. Department of the Treasury should convene key gold refiners and traders, industry associations, and banks to highlight the need for better implementation of the red flags in the FATF typology report on gold. The United States and European FIUs should follow up with the Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG) on next steps for implementing the FATF typology on gold, including through future mutual evaluations.

- Stopping smuggling by plane. The International Civil Aviation Organization (ICAO) and the World Customs Organization (WCO) should develop rules for airlines to prevent the smuggling of gold by hand on commercial airlines, and donor governments should provide assistance focused on detecting smuggled gold to airlines with routes that service key smuggling airports in the Great Lakes region.

Take Action

Take action with the Enough Project to urge the United States, European Union, and United Nations Security Council to investigate and, if appropriate, sanction gold refining and trading companies and their owners that are found to be involved in activities that threaten Congo’s peace, security, or stability through the illicit trade in natural resources. The US and Europe and East African countries should also combat money laundering associated with conflict gold through anti-money laundering measures. Click here to take action now.